Information relating to selected provisions of Act No. 235/2004 Coll. for VAT payers

updated 20. 06. 2022

With respect to the accession into the European Union the Czech Republic, as a member state, had to adjust its tax system to principles governed by legislation of the European Community. One of the areas that were affected by this change is the value added tax schedule imposed on business carried out within the EU common market.

This document, which generally concerns the cases of supply and acquisition of goods to and from member states including new duties of VAT payers resulting from introduction of a new schedule. In form of special schedules, there are also exceptions from the general principle of taxation of transactions made within EU, which are governed by a new act No. 235/2004 Coll., to regulate the value added tax.

- Supply of goods

- Acquisition of goods

- VIES system

- Recapitulative statements

- Submission of recapitulative statement

- Adjustment of the VAT return

- Verification of acquirer’s VAT ID

- VAT ID and the code of the Czech Republic

- Special schedules

- Contact

- Services

Supply of goods into another member state, export of goods

Pursuant to the new law on value added tax that came into force upon the accession of the Czech Republic into the European Union, i.e. on 01/05/2004, with respect to acquirers of goods from the European Union member states the current term “export of goods” is substituted by the term “supply of goods into another member state” or the so-called “intra-Community transactions”.

Supply of goods into another member state is considered to be an VAT-exempt transaction with the entitlement to claim VAT deduction in a case that:

- an acquirer of goods is registered for VAT in another member state of the European Union, i.e. it was assigned a tax identification number (VAT ID; in Czech: DIČ) for VAT,

- and the goods were actually sent or shipped to another EU member state by a payer or an acquirer or an authorized third person.

Exemption cannot be exercised in the case that the goods are supplied to a person, for whom the goods acquired in another member state will not be subject to taxation. To exercise tax exemption the supplier will be obliged to state and check the validity of VAT ID of its customer, which was assigned in another member state of the European Union.

When the goods are supplied to third countries outside of the European Union the current regulations for export of goods will be maintained.

In general it is possible to outline three basic situations of VAT imposition on supply of goods outside the CZ 1:

| 1. Supply of goods to a taxpayer who is registered for VAT in another member state | |||

|---|---|---|---|

| CZ(EU member state) VAT payer | ›› | State of the Acquirer - EU member state Taxpayer registered for VAT |

When the goods are delivered into another member state to a person who is registered for VAT in another member state, transaction is exempted with the entitlement to claim the VAT deduction (§ 64 of the new VAT Act) Thus the Czech taxpayer will supply the goods for prices without tax and it will declare these supplies in its VAT return as supplies of goods into another member state. The payer informs about the supply of goods into another member state that is exempt from VAT in its recapitulative statement (see below). The acquirer of the goods who is registered for VAT in another member state is obliged to declare the goods and tax it in its VAT return at its home country. |

| 2. Supply of goods to a person who is not registered for VAT in another member state | |||

|---|---|---|---|

| CZ(EU member state) VAT payer | ›› | State of the Acquirer - EU member state Person not registered for VAT |

When the goods are delivered to a person who is not registered for VAT in another member state or to a person, for whom acquisition of the goods from another member state is not subject to taxation, it is not an exempt transaction. The goods are supplied for a price including VAT according to the tariff in inland. A special procedure is described in the part distance sale of goods (see special schedules). |

| 3. Export of goods into third countries | |||

|---|---|---|---|

| (EU member state) VAT payer |

›› | State of the acquirer - so called Third Countries outside of EU VAT Payer not Non-VAT Payer | When the goods are delivered into a third country that is not an EU member, it is export of goods that is tax exempt with a right to deduct VAT regardless whether the goods acquirer is registered to VAT in its country or not. The transaction is subject to taxation in the country of the acquirer of the goods. A Czech payer will supply the goods for prices without tax and it will declare in its VAT return as export of goods. The right to exemption will be proved based on a confirmed customs declaration.The acquirer of the goods residing outside of the EU, a payer or non-payer of VAT, is obliged to tax the goods in its country when crossing the border according to local regulations. |

1Besides the mentioned general rules, there are exceptions where different taxation schemes are applied in specific cases. Besides the mentioned general rules, there are exceptions where different taxation schemes are applied in specific cases.

Acquisition of goods from another member state

Pursuant to § 2 of the new VAT Act, acquisition of goods from another member state by a taxpayer is subject to taxation in the Czech republic. Unlike import of goods from third countries the goods are not taxed upon crossing of the border, but the taxpayer declares tax in its tax return and VAT listings e-form (VAT Control Statement). In this case the administrator of tax is not a customs office, but a tax office with local jurisdiction.

VIES system

Within administration of VAT on supply of goods or provision of services into another member state, it is necessary to deal with documenting of exemption from VAT.

As from the accession of the CR into the European Union, our country has become a member of the Common Internal Market with free movement of goods, services, capital and labour, which was created by EU member states on 01/01/1993. Elimination of internal borders and border checks under conditions of a moderate schedule of exemption could cause a significant increase of tax evasions. Therefore EU member states had to implement new procedures enabling checks of exercising of entitlement to exemption from VAT upon supply of goods/provision of services into another member state.

With respect to the aforementioned, a community system of exchange of information about VAT was created within the European Union. The electronic system VIES (VAT Information Exchange System) is a system which enables tax administrators of EU member states to check whether the supplier was entitled to exempt the taxable supply, and on the other hand, it enables to check whether the acquirer duly declared and taxed the acquired goods/services in a country of destination.

The VIES system is designated to ensure exchange of information about carried out intracommunity transactions and identification data of persons registered to VAT in individual member states.

With respect to implementation of the VIES system in the Czech Republic as from the accession into EU, the duties of Czech VAT payers doing business with EU member states have changed.

Recapitulative statements

To ensure checks of eligibility of exercised right to exemption from VAT upon supply of goods or provision of services into another member state, the VAT-payers are obliged to submit the tax return together with so-called “recapitulative statement” (§.102 of the VAT Act) to the tax administrator with local jurisdiction.

The recapitulative statement is a brief and outlined e-form where the tax-payer gives summary information about the goods that were supplied by the payer into another member state exempt from VAT during the previous month (including relocation of own goods) and since 1. 1. 2010 also provided services are included by which the place of fulfilment is determined in accordance with section 9 paragraph 1 of the VAT Act, if a acquirer is obliged to declare and pay tax from these services.Furthermore, in accordance with the Section 18 of the VAT Act, the recapitulative statement also includes the delivery of goods under "call-off stock" regime (more information on this regime can be found - here).

In individual lines of the summary report the payer declares the following information concerning every acquirer of the goods:

- code of the country where the acquirer is registered,

- VAT ID of the acquirer,

- total value of goods supplied/provided services to the acquirer in a respective month/quarter,

- lines of “call of stock” regime.

If the tax-payer does not supply the goods/provided relevant services into another member state of the European Union in the respective month/quarter, the recapitulative statement is not to be submitted.

Submission of Recapitulative Statement

Since 1. 1. 2010 recapitulative statement must be submitted only in electronic way. More about submission of recapitulative statements and its principles you can find – here.

Verification of acquirer’s VAT ID (DIČ)

As it has been stated above, one of the conditions to exercise exempt from VAT in the case when the goods are supplied into another member state is that the acquirer of the goods/services is registered to VAT in another state, i.e. it was assigned VAT ID to be able to pay VAT. To exercise the exempt the supplier is obliged to state and check the validity of its customer’s VAT ID issued in another member state.

For this purpose every member state has to provide all persons who do intra-Community transactions with the possibility to verify the validity of VAT ID of their business partner registered to VAT in another member state, as well as the code of that country.

In order to verify the validity of VAT ID issued in another member state, Czech value added tax payers will be able to contact personally, over the phone, by mail, fax or email tax authorities or respective section of the General Financial Directorate CZ (division CZ CLO).

An official in charge will provide for verification of VAT ID in the national VIES system, through which it gets a direct access into registers of persons registered for VAT in all member states.

The information whether the respective VAT ID of the acquirer from a member state of the European Union is registered in a respective country can be obtained also at the server of the European Union.

VAT ID and code of the Czech Republic

With respect to the accession of the CZ into EU, the structure of VAT ID assigned to the registered tax payers in CZ changed.

The change of the VAT ID format does not only apply to VAT payers who do intra-Community transactions, but also to all tax payers registered in the CZ in compliance with Act No. 280/2009 Coll., Tax Code as amended.

The tax identification number comprises the code of the country “CZ” and core part of the existing VAT ID (i.e. in most cases it is a birth number of a natural person or company ID = IČO in the case of the legal entity). That means that the code CZ is at the beginning instead of the existing code of the tax administrator. Each taxpayer is obliged to state VAT ID in a new format in its tax documents regardless whether it does intra-Community transactions or just domestic business transactions.

Using of VAT ID in a new format is not conditioned by the issuance of a new certificate of taxpayer’s registration. The existing certificate of registration remains valid. The change of the VAT ID structure was bound by the law, based on which tax authorities carried out the automatic change in their internal systems. Any taxpayer can require that its tax administrator designates the change of the tax identification number in the certificate of registration.

SPECIAL SCHEDULES

The general principle of the VAT schedule exercised upon supply into other member states is described above. Besides that the VAT Act regulates specific procedures, which should be used in compliance with EU regulations.

Further in this respect, we will describe a simplified principle that the VAT Act regulates for cases of follow-up supply of goods between persons registered to VAT in three different states as well as specificities of supply and acquisition of new means of transport and distance sale of goods within EU.

Triangular business

Triangular business is governed by the new VAT Act as a form of business carried out within EU when it is possible to exercise the simplified VAT schedule for supplies and acquisition of goods between persons registered for VAT in different member states. The simplified schedule can be used only when all statutory conditions are met.

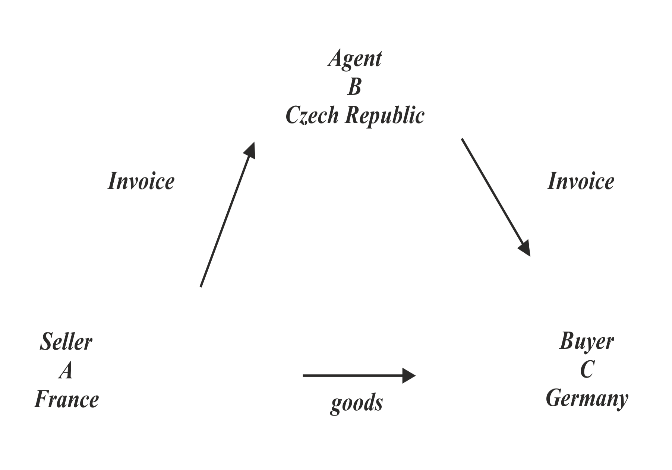

Triangular business is a deal made by three persons (seller, agent, buyer) registered for pay tax in three different member states, and an object to this deal is the supply of goods between these persons provided that the goods are directly sent or shipped from seller’s member state into buyer’s member state.

Simply we can say that the goods are supplied from one member state to a customer in another member state through an agent in a third member state. For example a German company orders the goods produced in France from a Czech company. The scheme of triangular business is depicted in the chart below.

Figure – scheme of triangular business

The simplified procedure lies in the fact that the payer (agent) in the member state B will declare this transaction neither in the input nor in the output in its tax return for the taxed period when it acquired the goods from another member state (i.e. state A) and supplied the goods into another member state (i.e. state C).

In the practice it will be as follows:

The seller:

- will physically ship or send the goods to the buyer in the member state C

- will issue an invoice to the agent where it will state VAT ID of the agent and the code of the agent’s country and statement that it is an exempt transaction

- will declare the exempt transaction in the tax return

- will show this transaction in the recapitulative statement (code of the transaction – 0)

The agent:

- will issue an invoice to the buyer where it will state VAT ID and the code of the country of the buyer and the statement that it is triangular transaction

- will show this transaction in the recapitulative statement with the code for triangular business (code of the performance – 2)

- will show the information about acquisition of goods from another member state by an agent and supply of goods into another member state by an agent in its tax return

The buyer:

- will declare and levy VAT for acquisition of goods from another member state in its tax return. (The payer will be entitled to deduction of this tax pursuant to the VAT Act.)

Supply of new means of transport

Another exception is the VAT schedule used for supply of new means of transport within EU. In this schedule there is always a principle that the place of taxation is in the country of destination regardless whether the supplier or acquirer is registered for VAT or not.

| 1. Supply of new means of transport by a VAT payer to a person that is registered for VAT in another member state | |||

|---|---|---|---|

| CZ(EU member state) VAT payer |

›› | State of the acquirer - EU member state Person registered for VAT |

The payer who supplies new means of transport for money into another member state to a VAT payer registered for VAT does the transaction exempt from tax with an entitlement to tax deduction. A Czech payer will supply new means of transport for a price without tax and will declare this transaction in its VAT return as a supply of new means of transport into another member state (§ 64 art. 2) to a person registered for pay tax in an EU member state. It will show the supply of new means of transport to persons registered for pay tax in other member states in its recapitulative statement. The acquirer of new means of transport who is a VAT payer in another member state is obliged to declare the acquisition of new means of transport and tax it in its home country in its VAT return. |

| 2. supply of a new means of transport by a VAT payer to a person that is not registered for VAT in another member state | |||

|---|---|---|---|

| CZ(EU member state) VAT payer |

›› | State of the acquirer - EU member state Person not registered for pay VAT |

If the payer supplies new means of transport to another member state to a person that is not registered for pay tax in another member state, also in this case it will do the transaction exempted from tax with an enntitlement to tax deduction. In comparison with a common supply of goods into another member state, the payer will not state this supply of new means of transport in the recapitulative statement. The acquirer of new means of transport will be obliged to declare and tax this acquisition in its home country, even if it is not registered for pay tax. |

Distance sale of goods

Pursuant to the Section 4 (9) of VAT Act: The distance sale of goods shall mean the delivery of goods if

- the goods are dispatched or transported from a Member State other than the Member State in which the dispatch or transport ends

- the taxable person who supplies the goods, or

- by a third party where the taxable person supplying the goods intervenes in such dispatch or transport, in accordance with directly applicable European Union legislation laying down implementing measures for the Directive on the common system of value added tax;

- the goods are supplied to a person for whom the acquisition of the goods is not subject to tax in the Member State of termination of the dispatch or transport; and

- it is not a supply of a new means of transport or a supply of goods with installation or assembly.

Pursuant to the Section 4 (10) of VAT Act: The distance sale of imported goods means the distance sale of goods, provided that the goods are dispatched or transported from a third country to the territory of the European Union.

Place of supply when distance selling goods (Section 8 of VAT Act):

(1) The place of supply in the distance sale of goods is the place where the goods are located after the end of their dispatch or transport.

(2) The place of supply in the distance sale of goods is the place where the goods are located at the time when their dispatch or transport begins, if

- the taxable person selling the goods is established:

- in a Member State and does not have an establishment in other Member States, or

- outside the territory of the European Union and an establishment in only one Member State,

- the goods are dispatched or transported to a Member State another than the Member State in which the person selling the goods has his registered office or establishment, and

- the total value of the relevant transactions without tax did not exceed EUR 10.000 or the equivalent in national currency in the relevant or immediately preceding calendar year using the exchange rate published by the European Central Bank on 5th of December 2017 (hereinafter the 'equivalent in other currency') ; the total value of the relevant transactions means, for the purposes of determining the place of supply:

- goods sold at a distance, provided that the conditions under points (a) and (b) are met, and

- telecommunication services, radio and television broadcasting services and electronically provided services provided to a non-taxable person, provided that the conditions pursuant to Section 10i (3) of VAT Act are met.

The place of supply in the distance sale of goods by which the total value of the relevant transactions excluding tax exceeded the amount of EUR 10.000 or its equivalent in another currency shall be the place of supply pursuant to paragraph (1) (i.e. the place where the goods are located after the end of their dispatch or transport).

A person who distance sells goods pursuant to paragraph (2) may decide that the place of supply is determined pursuant to paragraph (1). In such a case, he is obliged to do so at least until the end of the second calendar year following the calendar year in which he so decided. This decision shall also be considered as a decision on the determination of the place of supply pursuant to Section 10i (5) of VAT Act.

Pursuant to section 8a of VAT Act: The place of supply for the distance sale of imported goods shall be the place, where the goods are after their dispatch or transport, if the goods are dispatched or transported to a Member State another than the Member State of importation; or this (import) transaction is administrated under the special regime: “One single administrative place” – so-called: “One Stop Shop regime”.

Special regime: One single administrative place (so-called: „One stop shop/OSS“):

The special regime of one single administrative place (OSS) is used only for VAT payment in the Czech Republic for selected transactions (pursuant to Section 110b (2) of the VAT Act), which are provided cross-border to final consumers in other EU countries and for which the supplier is obliged to pay VAT in the consumer's Member State consumption. The supplier (OSS user) registers with the OSS regime and pays VAT in only one EU Member State (i.e in our case in the Czech Republic), although this is a cross-border supply in the EU. More information on OSS mode can be found - here.

SERVICES

Imposition of VAT on services after the accession of the Czech Republic into EU

New rules valid since 1. 1. 2010 – you can find - here.

General Financial Directorate

Division: VAT International Cooperation (CZ CLO)

e-mail: vies.dph@fs.mfcr.cz

Attachments

Note: Submission of VAT Return is possible only electronically (format and structure .xml – Tax Portal: Hlavní stránka - Portál MOJE daně (mfcr.cz)).